Times Interest Earned Ratio Interpretation

The higher the ICR the lower the risk. This ratio grew to 31-to-1 in 1978 and 61-to-1 by 1989.

Times Interest Earned Tie Ratio Formula And Calculator Excel Template

Use of PE ratio.

. Compute price earnings ratio. As long as enough profits are being generated to do so then a borrower is judged. It surged in the 1990s hitting 366-to-1 in 2000 at the end of the 1990s recovery and at the height of the stock market bubble5.

Interpretation of Financial Ratio Analysis. From 2008 to 2010 Revenues increased by 558 64306 in 2010 versus 60909 in 2008. The times interest earned ratio calculates the number of times that earnings can pay off the current interest expense.

In this example Rons company earned a profit of 90000 for the year. Analysis-The times interest ratio is stated in num-bers as opposed to a percentage. The interest coverage ratio interpretation suggests the higher the ICR the lower the chances of defaults.

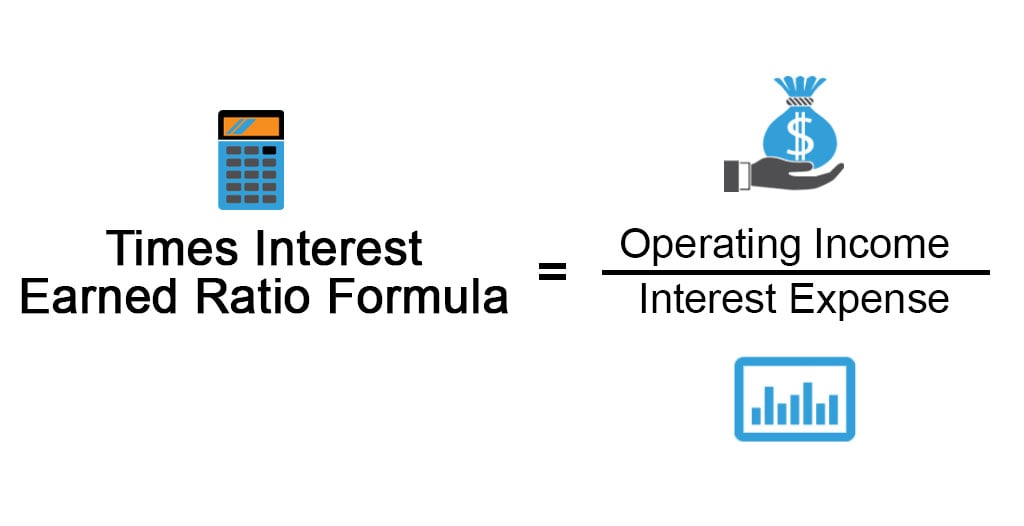

A ratio analysis is a quantitative analysis of information contained in a companys financial statements. Compare the times interest earned ratio formula shown below with the formula for the fixed-charge coverage ratio as shown. Could be considered a solvency ratio.

This was around 2000 BCE in Assyria India and SumeriaLater in ancient Greece and during the Roman Empire lenders based in temples gave loans while accepting deposits and performing the change of. However Interest Coverage Ratio decreased from 1955 times in 2008 to 963 times in 2010. As Table 1 and Figure A show using the realized measure of CEO compensation CEOs of major US.

The ideal debt to equity ratio will help management to make expansion decisions for further growth of business and increase its share in the market by adding more units or operations. The ra-tio indicates how many times a company could pay the interest with its before tax income so obviously the larger ratios are considered more favorable than smaller ratios. It means the earnings per share of the company is covered 10 times by the market price of its share.

The times interest earned ratio of PQR company is 803 times. Also referred to as the times interest earned ratio it helps people to figure out the risk associated with the lent amount. Times interest earned ratio.

50 5 10. The price earnings ratio of the company is 10. The history of banking began with the first prototype banks that is the merchants of the world who gave grain loans to farmers and traders who carried goods between cities.

Limitations of Interpretation of Debt to Equity Ratio. In the example above Jeffs salon would be able to meet its fixed payments 417 times. It means that the interest expenses of the company are 803 times covered by its net operating income income before interest and tax.

Thus lenders look for a significant ratio to. One ratio calculation doesnt offer much information on its own. The Interpretation of Financial Statements.

Thus Rons EBIT for the year equals 150000. This ratio earnings before interest and taxes EBITinterest expense measures how well a business can service its total debt or cover its interest payments on debt. Interpretation of the Fixed-Charge Coverage Ratio.

The most common of these ratios are the debt to equity ratio and the times interest earned ratio. The earnings per share ratio EPS is the percentage of a companys net income per share if all profits are distributed to shareholders. In other words 1 of earnings has a market value of 10.

In order to calculate our EBIT ratio we must add the interest and tax expense back in. Some of the Limitations of Interpretation of Debt to Equity Ratio are. The earnings per share ratio tell a lot about the current and future profitability of a company and can be easily calculated from the basic financial information of an organization that is easily available online.

Another form of gearing ratio is the times interest earned ratio which is calculated as shown below and is intended to provide some indication of whether a company can generate enough. In other words a ratio of 4 means that a. It is important to note that a higher Interest Coverage Ratio is a.

For example if a companys earnings before taxes and interest amount to 50000 and its total interest payment requirements equal 25000 then the companys interest coverage ratio is two. Ratio analysis is used to evaluate various aspects of a companys. The FCCR is used to determine a companys ability to pay its fixed payments.

PE ratio is a very useful tool for financial forecasting. Companies earned 21 times more than the typical worker in 1965. Financial ratios are only valuable.

The Interpretation of Financial Statements.

Times Interest Earned Ratio Formula Examples With Excel Template

Times Interest Earned Learn How To Calculate An Use The Tie Ratio

Times Interest Earned Tie Ratio Formula And Calculator Excel Template

Times Interest Earned Ratio Debt To Total Assets Ratio Analyzing Long Term Debt Youtube

No comments for "Times Interest Earned Ratio Interpretation"

Post a Comment